Look for the welcome email in your inbox #

- Look for a welcome email from support@raise.team

- Click the button that says Get Started

First time only: #

Reset your password #

- If this is your first time signing into the portal, you’ll be asked to choose a new password – and then re-type your password to confirm.

Accept the privacy policy #

- Your first time signing into the portal, you’ll be asked to read the Privacy policy.

- Click I accept to continue.

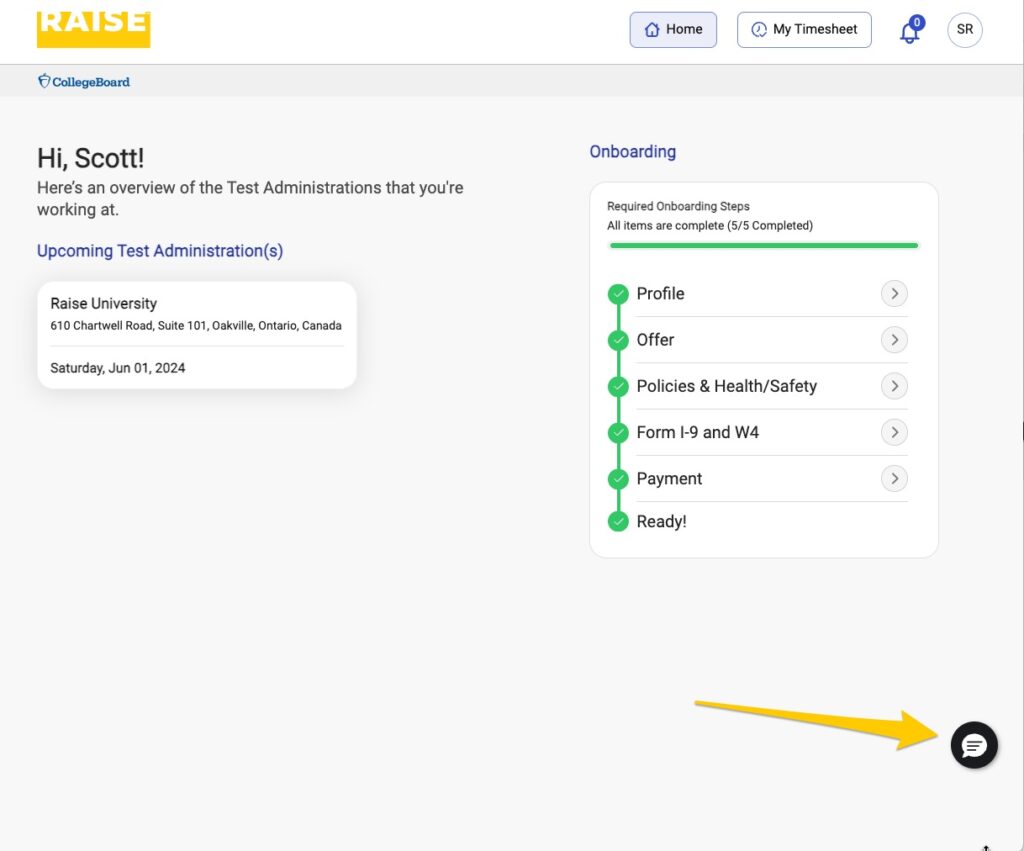

How to get support if you need it #

If you need help along the way, two quick ways to reach us are:

- Email support@raise.team

- Click the Chat button in the bottom right corner to open a chat conversation with Raise.

Get started #

- On the right-hand side, click Start to begin your onboarding.

Complete the Profile #

- Please make sure that your legal name (first name, last name, middle name) and address match your government-issued ID, as this information will be used to fill forms later, and save you re-entering the same information.

- The Preferred Name field is where you can provide the name you want to be addressed by in emails, calls or chats with Raise.

- When your profile is complete, click Save & Next.

Read and sign your Offer #

- If you meet the eligibility criteria listed in the Offer section, click the checkbox next to Yes, I meet the Eligibility Criteria Above.

- Scroll through your Agreement to read it.

- To continue, click Yes, I Agree.

- To sign the offer, click Continue to Sign.

- Draw your signature in the box provided.

- Click Sign & Complete.

- Click Save & Next.

Sign your policies #

- Click the Preview button to download the Policies and read before you sign.

- Click Apply Signature to add your signature. This applies the signature from your Agreement.

- Click the Preview button to download the Health & Safety information and read before you sign.

- Click Apply Signature to add your signature. This applies the signature from your Agreement.

- Click Save & Next.

Submit payment information and tax forms #

For security, you will likely be asked for a two-factor authentication code during this process. When prompted, enter your mobile phone number. The system will text you a code, which you will need to enter promptly to continue.

Confirm your address #

- Under Type, choose Individual.

- Confirm the address information shown here is the same as the information your bank has on file for you.

- Click Next.

- If this information is incorrect, return to the Profile section (the first step) to update your information.

Confirm your payment method #

- Use the dropdown to choose how you would like to receive payment.

- The fields of necessary information will change depending on what payment type you choose.

- Enter the necessary information for your payment type (e.g., bank details, PayPal account details, wire transfer details, address, etc.)

Fill and submit your tax forms #

- If you work and pay taxes in the United States (i.e., you’re an American citizen or permanent resident) – select W9 – for US individuals/entities.

- Click Complete Form.

- Complete the information on the W9 form.

- Click Next.

You should not complete the W9 form unless you’re a US citizen or US tax resident.

If you’re not an American citizen and you’re working outside the US, please see this support document instead.

Ready to work #

- When all your documents are complete and submitted, you’ll see that you’re ready.

- You can download signed copies of your Agreement, your Policies, and your Health & Safety documents for your records.